Labor Standards FAQ

Haga clic aquí para ver esta página en español.

Wages & Paychecks

The current minimum wage is $15.00/hour per hour (as of January 1, 2025). There are some exceptions, such as for full-time students working in certain industries. Click here for a full list of exemptions.

If your employer isn’t paying you the minimum wage, you should file a wage complaint.

Most Rhode Island employers are required to pay their employees every week. However, there are exceptions for state entities as well as religious, literary, or charitable corporations, and other types of employers can also be granted exceptions to this requirement. Employers with exceptions are required to pay wages at least twice per month.

If your employer isn’t paying you on time, you should file a wage complaint.

All employers are required to keep an accurate daily and weekly record (time in and out) for all employees. Employers are also required to give you a pay stub (a piece of paper with every paycheck explaining how much you were paid) each time you are paid. These records, along with payroll records, must be kept for at least three years.

If you think your employer isn’t keeping or providing correct pay records, you should file a wage complaint.

Yes. Your employer is required to provide you with a paystub every payday showing the hours worked, any deductions made from your earnings, and an explanation of those deductions. Even if you’re paid in cash, your employer needs to give you a paystub. The paystub can be either physical copy or digital record.

If your employer isn’t giving you a paystub, you should file a wage complaint.

If you think your employer didn’t send you your final paycheck, you should file a wage complaint.

No. Employers aren’t allowed to deduct from your pay for spoilage, breakage, shortages, or losses.

If you think your employer is making illegal deductions from your pay, you should file a wage complaint.

No. Under RIGL § 28-14-9, DLT is not able to enforce the payment of bonus pay.

If you think your employer did not correctly pay you commission, please file a wage complaint.

Workers Receiving Tips

Employers can pay tipped workers a minimum of $3.89 per hour, but your earnings including tips must add to the regular minimum wage of $14 per hour. If your wages plus tips don’t add up to the regular minimum wage, your employer is required to pay you the difference.

If you think your employer isn’t paying you correctly, you should file a wage complaint.

If you don’t earn enough in tips to reach the regular minimum wage, your employer is required to pay you the difference.

If you think your employer isn’t paying you correctly, you should file a wage complaint.

Yes. If you’re a tipped worker, your employer is required to pay you at least $3.89 per hour, even if you end up earning over the regular minimum wage in tips alone.

If you think your employer isn’t paying you correctly, you should file a wage complaint.

No, your employer is not allowed to take any of your tips. The only exception is for credit card processing fees, which your employer must notify you about in advance.

If you think your employer is illegally taking your tips, you should file a wage complaint.

Overtime & Holiday Pay

In any workweek in which an employee of a retail business is employed on a Sunday or a holiday, or both, at a rate of one and one-half (1½) times the regular rate at which he or she is employed as provided in § 5-23-2, the hours worked on the Sunday or holiday, or both, shall be excluded from the calculation of overtime pay as required by this section.

A “retail business” can be defined as an establishment engaged primarily in the sale of goods or services directly to the general public. It operates at the end of the distribution chain, selling in small quantities to the ultimate consumer in a manner consistent with other consumer goods and services. A retail business does not engage primarily in resale, wholesale transactions, or manufacturing but instead provides products or services recognized as retail within the particular industry. This definition includes direct-to-consumer sales and aligns with the Merriam-Webster definition of retail as "to sell small quantities directly to the ultimate consumer." Excluded from this definition are businesses that primarily prepare and sell food for immediate consumption, as well as wholesale operations that serve other businesses rather than individual consumers.

In general, yes. If you work more than 40 hours in a week, you must be paid one and one-half times your regular rate of pay for any additional hours worked after the standard 40 hours.

However, there are some exceptions, including employees of summer camps that are not open for longer than six months, police officers, employees of an elected collective bargaining agreement (state legislators, municipal government, statewide government), general employees of the state, car and farm equipment salespeople, and anyone employed in agriculture. For a full list of exceptions, please see RIGL § 28-12-4.3.

If you think your employer didn’t pay you correctly for overtime hours, you should file a wage complaint.

Employees must be paid at least one and one-half times your normal rate of pay for any work performed on Sundays and holidays.

However, there are exceptions, including workers in health care, hospitality, agriculture, and commercial fishing. Please click here for a full list of exceptions.

If you think your employer didn’t pay you correctly for Sunday or holiday work, you should file a wage complaint.

Breaks & Leave

Employees must be given a twenty-minute mealtime for a six-hour shift, and a thirty-minute mealtime for an eight-hour shift. Employers are not required to compensate employees for this mealtime.

However, this law does not apply to workers in licensed healthcare facilities or companies employing fewer than three employees at one site during a shift.

If your employer is not correctly providing you breaks, please file a wage complaint.

Most RI employees have the legal right to earn sick and safe leave from work. Employers with 18 or more employees are required to offer paid sick and safe leave. Employers with fewer than 18 employees must provide sick and safe leave time, although it doesn’t need to be paid. Covered employees may take up to 40 hours of leave. Learn more about sick and safe leave here.

No, employers are not required to provide paid vacation time. However, if your employer does provide vacation time, they are required to pay out any remaining accrued vacation pay upon separation if you work for them for at least one year.

Worker Misclassification

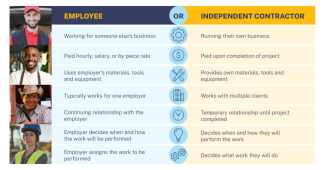

Sometimes employers incorrectly – and illegally – classify employees as independent contractors to avoid providing certain worker benefits and paying taxes. This is called worker misclassification.

Check out the graphic below to see the difference between employees and independent contractors.

If you think your employer is misclassifying you, you should file a wage complaint.

Other

No. Employers are not allowed to charge a fee for filing employment applications.

Minors aged 14 to 17 are allowed to work, but there are specific rules and requirements in place to ensure their protection. Please see Child Labor Laws for more information.

Rhode Island Fair Employment Practices fosters the employment of all individuals in this state in accordance with their fullest capacities, regardless of their race or color, religion, sex, sexual orientation, gender identity or expression, disability, age or country of ancestral origin, and safeguards their right to obtain and hold employment without such discrimination.

RI General Law 28-5-7 makes it an an unlawful employment practice to discriminate in any aspect of employment including:

- Recruiting, Hiring and firing

- Refusing reasonable accommodation

- Compensation, assignment, or classification of employees

- Transfer, promotion, layoff, or recall

- Training and apprenticeship programs

- Pay, retirement plans, Fringe benefits or disability leave

- Other terms and conditions of employment

If you think your employer discriminated against you, please file a charge with the RI Human Rights Commission or fill out a complaint form with the Office of Diversity, Equity & Opportunity.